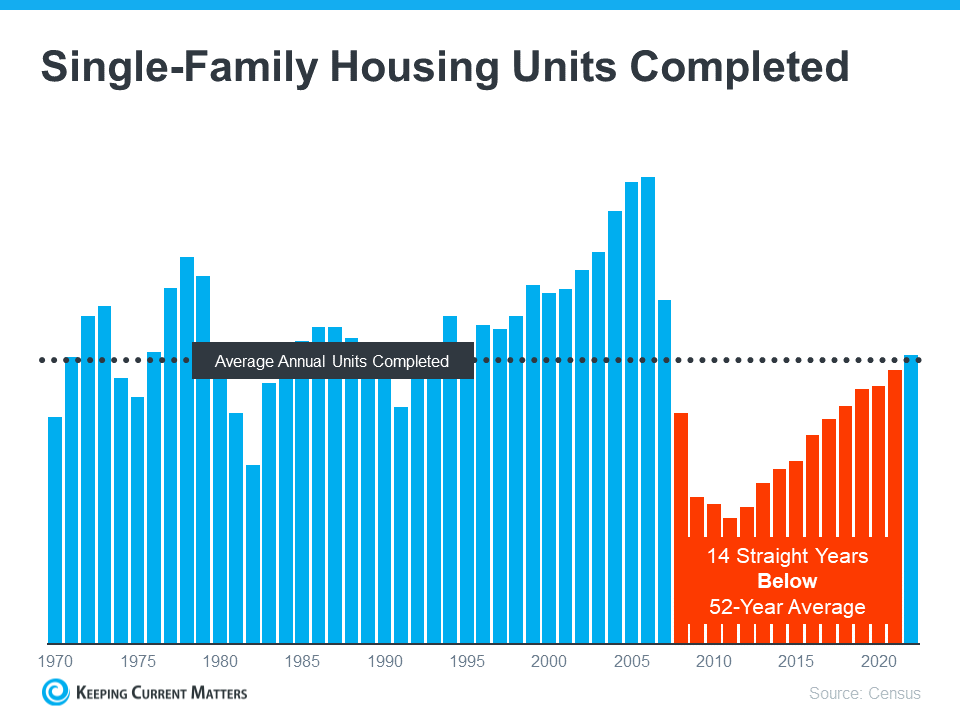

The last 14 years show that the new construction single family homes completed are well the 52-year average.

Analyzing the Shrinking US Housing Inventory: A Rollercoaster Ride

The ongoing struggle to find available properties in the United States has become a growing concern in recent years. With escalating demand and inadequate supply, the US housing inventory has reached historically low levels. Let’s explore the factors contributing to the scarcity.

The Housing Conundrum

Despite seeing a boom in the housing market during certain periods, the US is currently experiencing a shortage of available homes, leading to soaring prices and fierce competition among buyers. This dilemma can be attributed to several factors, such as population growth, preference shifts, and economic fluctuations. However, the lack of new construction has been a significant driver of the low housing inventory.

Statistics on New Construction

To gain a better understanding of the housing shortage issue, let’s delve into some eye-opening statistics related to new construction. According to the US Census Bureau, the historical data paints a clear picture of the decline in new construction over the past few decades:

1. Dwelling Starts:

Despite a gradual recovery after the 2008 financial crisis, new dwelling starts have significantly lagged behind historical averages. In 2020, there were approximately 1.38 million housing starts, which, while representing an improvement over the years following the Great Recession, is still 4% below the 1.44 million starts predicted by experts.

2. Affordability Crisis:

As construction fails to keep pace with rising demand, it exacerbates the affordability crisis. The National Association of Home Builders (NAHB) estimated that as of 2021, the US is short over 6.8 million homes to meet the demand, greatly impacting housing affordability for potential buyers.

3. Housing Permits:

Building permits, a crucial indicator of future construction activity, have also witnessed a significant decline. The US Census Bureau reported a 3.8% drop in permits issued for new residential construction in February 2021 compared to January 2021. This drop reflects the struggles faced by builders in obtaining permits due to regulatory barriers and bureaucratic delays.

Factors Behind the Shortage

1. Land and Zoning Restrictions:

Limited availability of land for development, combined with zoning regulations, hampers the ability to build new homes in highly sought-after areas. Stringent building codes, various restrictions, and slow approval processes hinder construction companies, limiting housing supply.

2. Skilled Labor Shortage:

The dearth of qualified workers in the construction industry has been a pressing issue. Following the 2008 financial crisis, many skilled tradesmen left the industry, and fewer young individuals pursued careers in construction. The labor shortage leads to longer construction timelines, increased costs, and ultimately lower new housing supply.

3. Rising Material Costs:

Escalating costs of building materials, such as lumber and steel, have further hindered construction projects. Unforeseen economic events, such as the COVID-19 pandemic and interruptions in global supply chains, have resulted in significant price hikes. These material costs have a direct impact on the construction industry, making projects less feasible and impeding growth.

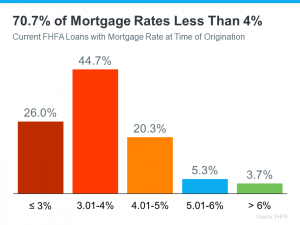

Mortgage Rates

The cost of financing is also having an impact inventory. The fact that so many homeowners locked in a below-average rate in 2020-2021 means that many of those possible sellers are reluctant to sell because of where mortgage rates are right now. They don’t want to move and take on a rate that is higher than the one they have on their current home.

Homeowners with a rate of less than 4% is over 70%

Media Sharing Inaccurate Information, Creating Unnecessary Fear

We’ve all seen the headlines stating that the housing market is going to crash or that housing pricing would fall by as much as 20%. In most markets, neither of those things happened but the confidence of consumers is affected by these negative news stories. Here in North Carolina, the market is still very strong and it could be that competition will only get worse as mortgage rates come down. As rates improve, more buyers will jump back in the search and we will see even more multiple offer situations, further driving the price of the home upward.

Large Companies Buying Single Family Homes for Rentals and Inflation

Blackrock, State Street, and Vanguard are buying as many single-family homes as they can in the US. The average homebuyer can’t compete against offers on properties from these companies. It’s forecasted that if they stay on their current trajectory, they will own more than 60% of the homes in the country.

Additionally, about two years ago, the average price of a house was $215,000; now, it’s $400,000. The government spent $8 trillion on wars and $16 on COVID and they print money that they don’t have, which makes everything cost more.

The limited US housing inventory can be attributed to various factors, including lack of new construction, mortgage rates going up, media fear, and inflation. Only with a comprehensive approach can the US hope to meet its housing needs, ensuring a more sustainable and inclusive future.

Reach me at sarah.wiley@cbcarverpressley.com

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link