Rent vs. Buy

For many people, renting is the only option available to them. Whether it is due to financial constraints, job circumstances, or simply a preference for less commitment, renting offers flexibility that owning a property cannot. However, while it may seem like a more economically sound decision in some respects, it can actually be more damaging than one may think.

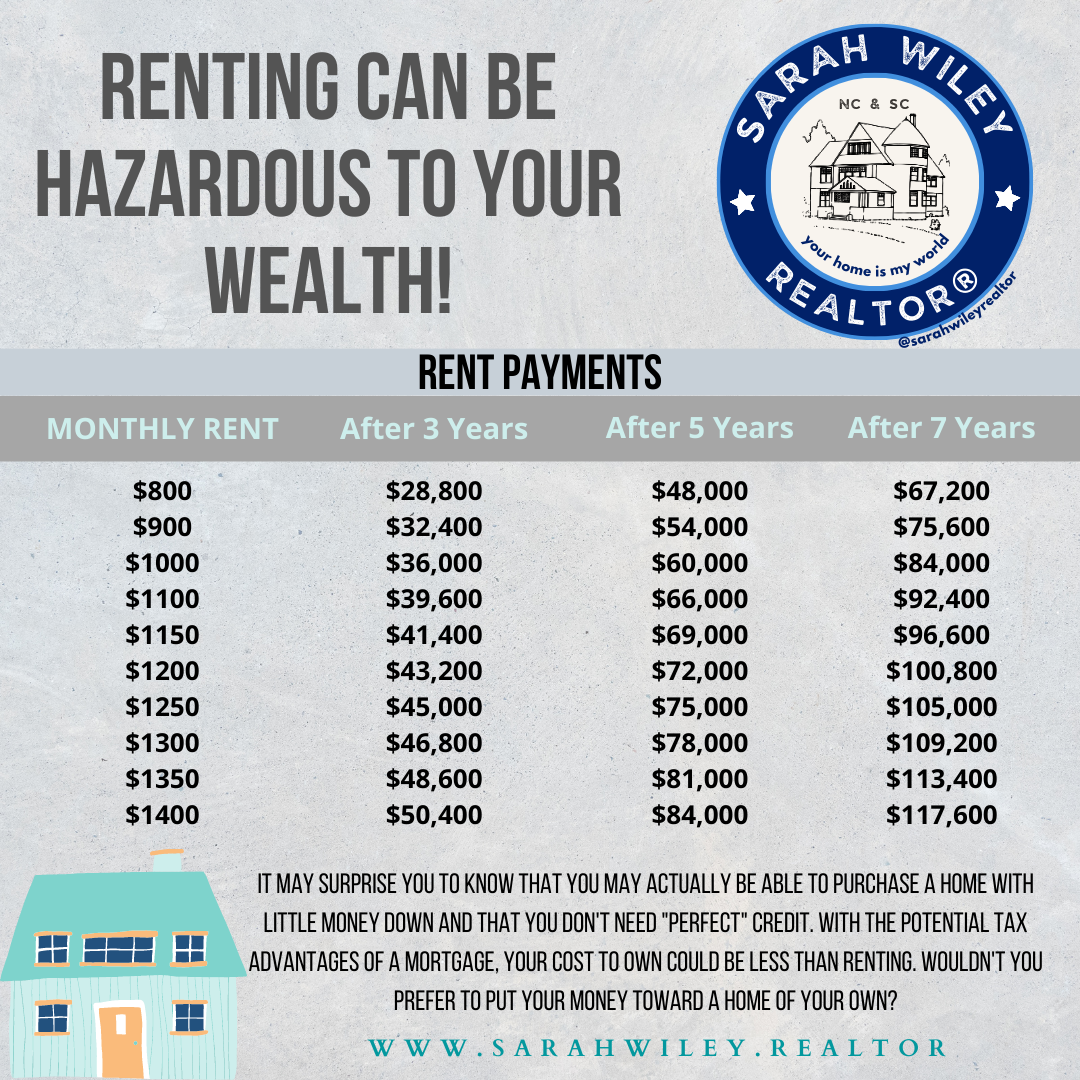

One of the biggest drawbacks of renting is the inability to build equity. Equity is the difference between the value of an asset and the amount of money owed on that asset. When it comes to renting, the tenant does not own the property, meaning that they have no equity in the home. This means that when someone is renting, they are essentially paying for someone else’s investment and not building any of their own equity. Renting can be hazardous to your wealth – just take a look at the table in the image!

Renting can be financially draining. The rental market can be notoriously competitive, and prices can be steep, especially lately. Sometimes rent prices can be so high that they leave the tenant struggling to make ends meet, leaving no room for savings. Moreover, rental prices can increase every time the tenant’s lease is up for renewal, which would make budgeting one’s finances even more challenging.

Work Toward Ownership – If Your Circumstances Allow

Only home ownership provides for tax advantages and appreciation. Real estate comes with valuable benefits that could add up to tens of thousands of dollars over time. Mortgage interests and property tax expenses are tax-deductible, leading to extra savings over time. Plus, real estate tends to appreciate over time, increasing the owner’s return on investment.

There is a handy calculator over at Calculator.net which demonstrates Rent vs. Buy.

While it’s certainly true that renting has its advantages, it’s also important to recognize the long-term financial implications it can have. Building equity, maximizing tax advantages, and taking advantage of property appreciation and tax benefits are all perks reserved for homeownership. So, if homeownership is feasible, it might be worth considering it as a potentially more financially sound investment option.

If you’d like to discuss options to take the next steps toward ownership, please get in touch: Email me

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link